Employee retention credit calculator

If you do not have a business with 100 or fewer workers then this part does not apply to you. Form W-4 is completed by employees and given to their employer so their employer can withhold the correct federal income tax from the employees pay.

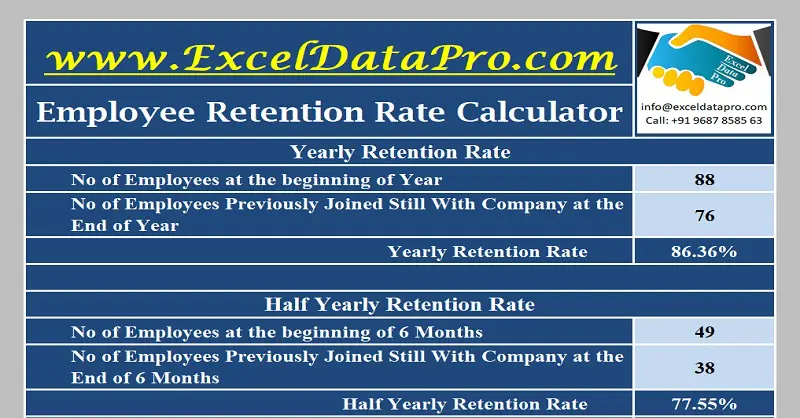

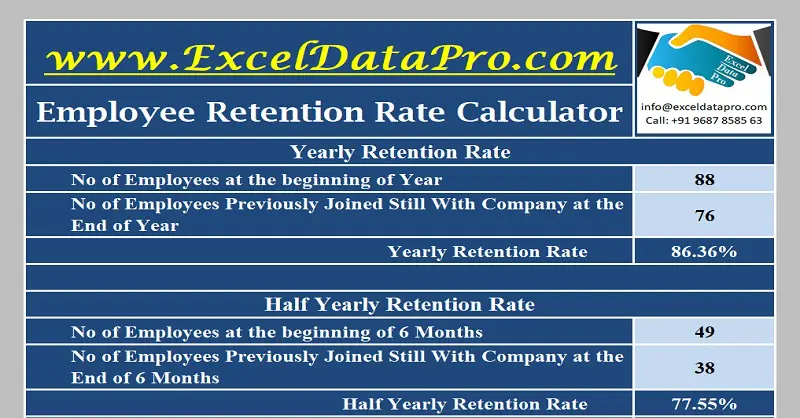

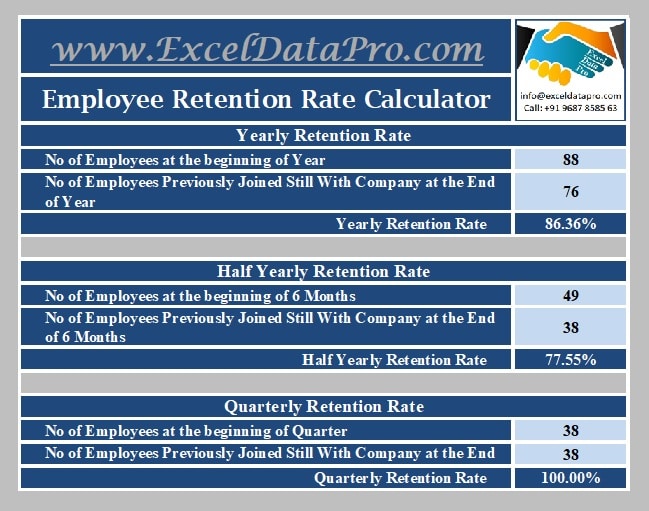

Download Employee Retention Rate Calculator Excel Template Exceldatapro

Understand the rules to qualify for the Employee Retention Tax Credit including an easy-to-follow flow chart illustrating the 2020 and 2021 rules including the extension to Q3.

. Updated Return to your claim and If you have missed the claim deadline section. Net Salary 660000 50000 57600 Net Salary 660000 107600. The FICA tip credit can be requested when business tax returns are filed.

So 50000 in Q3 50000 in Q4 2021. How to Calculate Net Revenue Retention NRR Net revenue retention NRR also known as net dollar retention NDR is a crucial key performance indicator KPI for SaaS and subscription-based companies. NRR is of particular importance in the SaaS industry because it is not only a measure of customer retention but also a companys ability to maintain high engagement and.

Its capped at 50000 per quarter. For 2021 the Employee Retention Credit is equal to 70 of qualified employee wages paid in a calendar quarter. The Employee Retention Credit ERC is a tax credit first put in place last year as a temporary coronavirus-relief provision to assist businesses in keeping employees on payroll.

A retention strategy is a plan that organizations create and use to reduce employee turnover prevent attrition increase retention and foster employee engagement. Basic Salary Dearness Allowance HRA Allowance conveyance allowance entertainment allowance medical insurance. You can estimate your potential tax credit using this WOTC Tax Savings Calculator from the DOL.

The Employee Retention Credit is more accessible to small business owners as well as recovery startup businesses who are struggling financially during the COVID-19 pandemic. Eligible wages per employee max out at 10000 so the maximum credit for eligible wages paid to any employee during 2020 is 5000. The amount of the potential tax credit is based on an estimate of 2400 per employee.

The ERC Calculator will ask questions about the companys gross receipts and employee counts in 2019 2020 and 2021 as well as government orders that may have impacted the business in 2020 and 2021. It is reported on IRS Form 8846 which is sometimes called Credit for Employer Social Security and Medicare Taxes Paid on Certain Employee Tips. 29 October 2021.

Learn IF you qualify for the expanded Employee Retention Tax Credits and HOW MUCH you could be refunded for 2020 retroactively and 2021. The ERC Calculator is best viewed in Chrome or Firefox. Employers who are eligible for ERC can receive tax credits in exchange for qualified wages and health plan expenses paid to and on behalf of employees.

Morgan survey found that just under half of businesses with less than 50 employees offer a retirement savings plan 63 percent of which said they had no plans to do so in the future. Information about Form W-4 Employees Withholding Certificate including recent updates related forms and instructions on how to file. Determine which quarters you qualify for the tax credit based on gross receipts as well as when you no longer qualify.

How to Claim and Calculate the FICA Tip Tax Credit. This ERTC calculator will help you. Use our simple calculator to see if you qualify for the ERC and if so by how much.

The Employee Retention Credit ERC has proven to be one of the most effective tax policies in helping small and medium businesses and tax-exempt entities weather the economic impact of the pandemic. Employee Retention Credit calculation spreadsheet 2021 can help businesses understand the impact of employee retention on their tax liabilities. The Employee Retention Credit ERC was created by the federal government to help ease the financial hardship caused by the COVID-19 pandemic on small businesses.

While some turnover is inevitable building a retention strategy to prevent as much voluntary turnover as possible can save an organization a lot of time and money. Updated information because the Coronavirus Job Retention Scheme ended on 30 September. Lastly for the employee retention credit you will need to gather any sales revenue from 2019-2020.

The Employee Retention Tax Credit ERTC is a provision in the Coronavirus Aid Relief and Economic Security CARES Act intended to help workplaces keep employees on their payroll during the downturn caused by the COVID-19 pandemic. Since then the. The calculator would.

Because you used the Coronavirus Job Retention Scheme to put them on furlough use what they would have earned normally when. About Publication 972 Child Tax Credit. The credit applies to wages paid after March 12 2020 and before January 1 2021.

The amount of the retention credit calculation is determined by your net income or your loss as well as how many full-time employees you have. So the good news here is your startup can save basically 7000 per employee on a tax credit assuming they pay at least 10000 or more to that employee in the eligible time periods. Employee files contain sensitive information so its important to keep them -- but for how long.

A high satisfaction level indicates that employees are happy with how their employer treats them. More specifically the ERTC is a fully refundable credit thats equal to 50 of qualified wages up to 10000 of wages per. Employee satisfaction is one key metric that can help determine the overall health of an organization which is why many organizations employ regular surveys to measure employee satisfaction and track satisfaction trends over time.

But once you determine that youre. Determining if the FICA tax tip applies to your business can be a challenge. Though a 401k plan continues to be a desired employee benefit some employers are still hesitant to adopt one.

Net Salary 552400 Here the basic salary will be calculated as follows. Like the Employee Retention Credit Employer-Paid Family and Medical Leave Credits other disaster retention credits or forgivable Paycheck Protection Program. Here are the standard retention periods for common HR records.

Employer calculator - calculate your employees statutory. The Employee Retention Tax Credit is a refundable payroll tax credit designed to encourage employers whose companies were disrupted by COVID-19 restrictions to retain employees and keep them on.

Ready To Use Employee Retention Credit Calculator 2021 Msofficegeek

Determining What Wages To Use For The Ertc And Ppp Youtube

Employee Retention Credit Erc Calculator Gusto

Download Employee Retention Rate Calculator Excel Template Exceldatapro

Calculating Your Employee Retention Credit In 2022

Employee Retention Credit Spreadsheet Youtube

Calculating Your Employee Retention Credit In 2022

Ready To Use Employee Retention Credit Calculator 2021 Msofficegeek

A Guide To Understand Employee Retention Credit Calculation Spreadsheet 2021 Disasterloanadvisors Com

2

Employee Retention Credit Erc Calculator Gusto

Employee Retention Tax Credit Calculator Krost

Determining What Wages To Use For The Ertc And Ppp Youtube

Ready To Use Employee Retention Credit Calculator 2021 Msofficegeek

Ready To Use Employee Retention Credit Calculator 2021 Msofficegeek

2

Qualifying For Employee Retention Credit Erc Gusto